Renters Insurance in and around Houston

Renters of Houston, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

- collin county

- river oaks

- San Antonio

- austin

- eagle pass

- dallas

- fort worth

- montgomery county

- piney point village

- hunters creek

- bunker hill village

- west university

- highland park

- tarrant county

- denton county

- williamson county

- alamo heights

- westlake

- lake travis

- new braunfels

- fort bend county

- galveston

- bexar county

- harris county

Home Is Where Your Heart Is

There's a lot to think about when it comes to renting a home - furnishings, utilities, internet access, condo or townhome? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Renters of Houston, State Farm can cover you

Your belongings say p-lease and thank you to renters insurance

There's No Place Like Home

The unanticipated happens. Unfortunately, the personal belongings in your rented space, such as a microwave, a tool set and a coffee maker, aren't immune to tornado or theft. Your good neighbor, agent Daniel Salinas, is passionate about helping you choose the right policy and find the right insurance options to help keep your things protected.

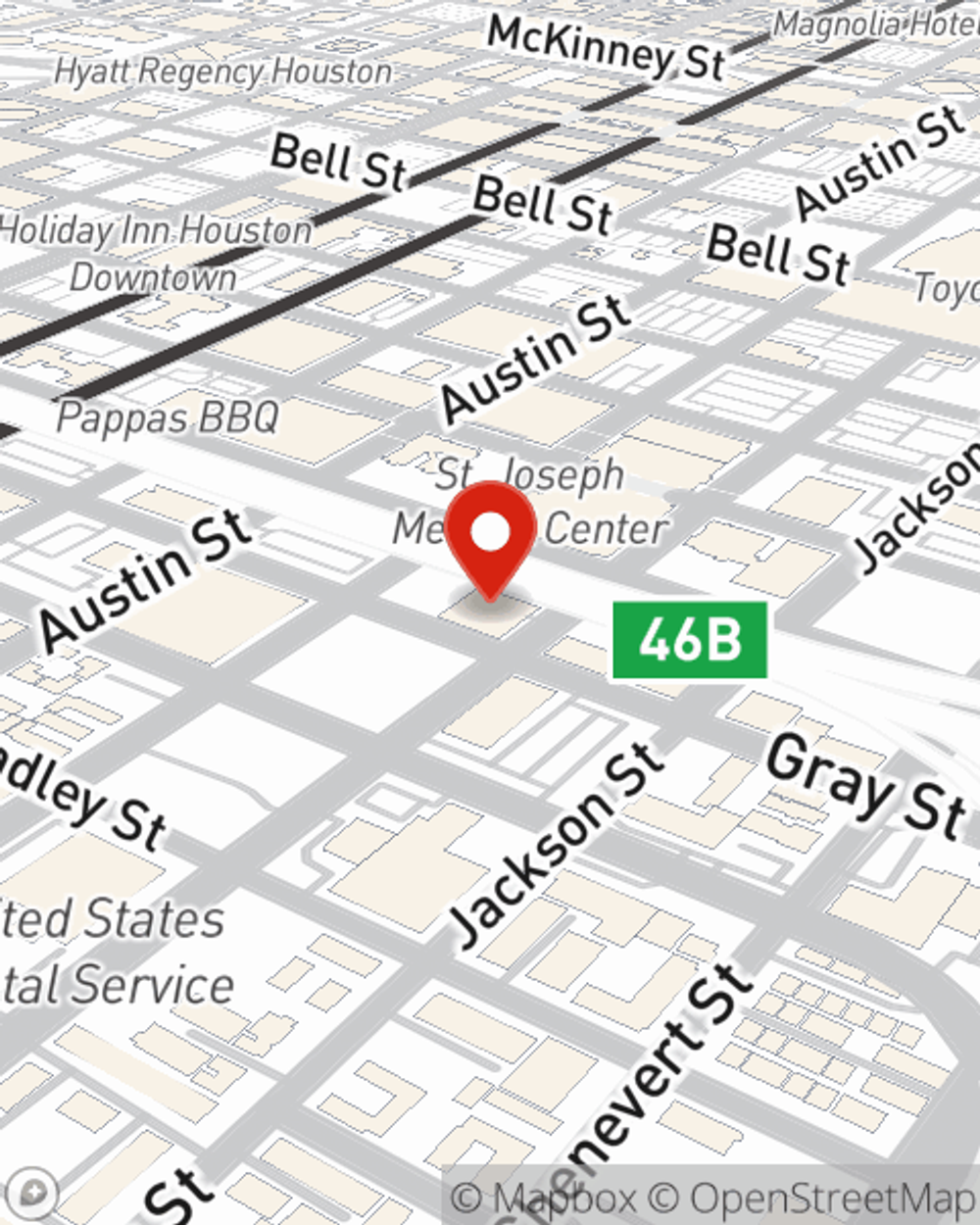

It's never a bad idea to make sure you're prepared. Get in touch with State Farm agent Daniel Salinas for help getting started on coverage options for your rented unit.

Have More Questions About Renters Insurance?

Call Daniel at (832) 871-4790 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Daniel Salinas

State Farm® Insurance AgentSimple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.